Regulation

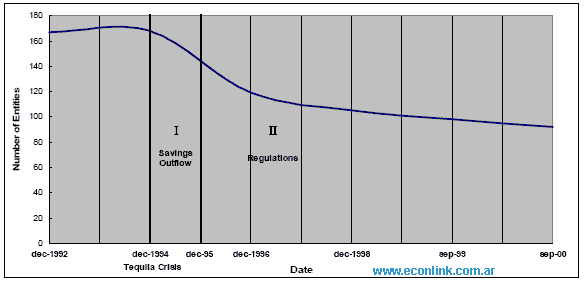

In a first stage from December 1994 up to October 1995 the concentration was caused by an outflow and reshape of deposits from small to large entities that provoked a drastic reduction in their number (almost 50% of the total). From that date the consolidation process was slower but steady until stopping a year before the crisis of December 2001. In this second phase the concentration was caused by the financial regulations implemented by the Argentinean government (see Figure 3). These regulations were implemented in order to reinforce the solvency and liquidity of the financial system on accordance with the suggested criteria of the Basel Committee of Banking Supervision, and determined the minimum capital and liquidity requirements13.

Figure 3. PHASES OF THE BANKING CONCENTRATION

Source: Author. Adapted from Cuadernos de Cuenin (2000) and data from BCRA.

At this point the empirical evidence has a correlation with the credit rationing theory formulated by Stiglitz and Weiss, taking into consideration that the regulations of Basel II had still not been implemented at 1981:

‘There is another form of rationing which is the subject of our 1980 paper: banks make the provision of credit in later periods contingent on performance in earlier period; banks may then refuse to lend even when these later period projects stochastically dominate earlier projects which are financed.’14

These government regulations consisted mainly in three points that affected the credit rationing directly.

* In 1993 the minimum capital requirements were established by the BCRA demanding a segmentation and adjustment of the assets in accordance with the risk exposure of them. Thus the riskier portfolios have to be supported by a larger amount of assets. As a consequence the banks were encouraged to increase their size in order to afford riskier projects with higher expected returns and in the other hand the small institutions, that had more risk exposure on average, were in some way penalized.

* In 1995 the bank reserve requirements were substituted by the minimum liquidity requirements which have less costs due to they can be invested in certain yielding assets specified by the BCRA, furthermore in all the cases they’ve to be high liquidity assets in order to be used to face urgent situations. The liquidity requirements were higher for the short term deposits and lower for the longer ones, thus a deposit for a period up to 89 days had an imposition of 20%, in between 90-179 days was 15%, 10% for 180-365 and 0% for deposits of more than 365 days. Even considering that these types of requirements could yield interest the smaller banks were still affected by this measure as the larger banks had relatively more deposits with longer maturity, probably because the different perception of trust.

* Up to this point the Argentinean regulation was in coincidence with the norms suggested by the Basel Committee, but going a step further the BCRA modified the definition of capital risk including the interest rate as a measure of risk factor. Thus the risk adjustment was increased as the interest rate applied to the loans and other actives increases. This risk indicator is applied on a range in between 0.8 and 6 (see Vrf variable below). This norm encourages lending at lower interest rates on the assumption that the interest rate is related with the risk of the investment, but in other way it provokes another problem of competition to smaller banks: on average smaller institutions in Argentina lent to smaller companies at higher interest rates (normally this kind of borrowers have more risk) penalizing this types of financial intermediaries and deepening the concentration.

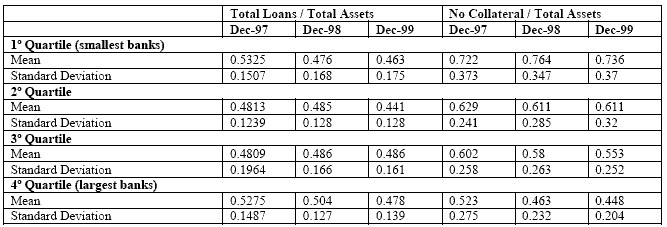

As we can see in Table 2 the tendency to lend to smaller companies was stronger in smaller financial institutions and in the same chart checking the ‘no collateral’ side we can have an idea of the average interest rates applied per type of company.

Table 2. LENDING TENDENCY TO SME SECTOR BY SIZE OF BANK.

ARGENTINA. 1995/1999

Source: Translated from Cuenin (2000).

Note: The first quartile represents the 25% of the smallest banks considering the assets

without taking into account the type of entity; the last quartile represents the 25% of largest banks. The higher the index the higher the tendency to lend.

* Another regulation in order to provide solvency and liquidity to the financial system was the implementation of the C.A.M.E.L.15 rating system supervised by the Superintendencia de Entidades Financieras y Cambiarias (Supervision of Financial and Exchange Entities). This internationally accepted standard (applied by the British regulation) measures the quality of banks and financial institutions regulated by the BCRA (formal sector) through a performance evaluation. The rating is compounded of 5 grades: the lower the grade the lower the minimum capital requirement factor, thus with a grade of 1 the bank has to adjust his capital requirements to a value of 0.97 and for a grade 5 the value is 1.125 (See the minimum capital formula below). The regulation COM “A” 2136 of the BCRA determines the formula to calculate the minimum capital requirement:

Cer = k * [a * Ais + c * (Ci + _Fspn) + r * (Vrf + Vrani)]

Where:

Cer: minimum capital required in function of the risk

K: CAMELBIG factor (1 = 0,970; 2 = 1,000; 3 = 1,050; 4 = 1,100; 5 = 1,150)

a: coefficient determined by the BCRA (from 1995 equal to 0,15, later was 0,10)

Ais: fixed assets c: coefficient determined by the BCRA (from 1995 was 0,125, at 2006 was 0,08)

Ci: positions in investment accounts Fspn: financings to the non-financial public sector r: coefficient determined by the BCRA (from 1995 was 0,115, at 2006 was 0,08)

Vrf: Risk value of loans, other credits due to financial intermediation except inter-bank operations. Obtained after the sum of the results of the following expression: p*Ir*f where p is the weighed measure as per type of asset (as per Annex I of the norm), Ir pondered measure as per interest rate (as per Annex II of the norm) and f is loans, other credits by financial intermediation and other financings – including guarantees, possible endorsement and other responsibilities except inter-bank operations)

Vrani: risk value of non-fixed assets not included in ‘f’, ‘Ci’ and ‘Fspn’ after the sum obtained of applying the following formula:

P*(Ani - f - Ci - Fspn)

Where p is the risk weight (as per Annex I of the norm) and Ani is the non-fixed assets

As we can see in the formula the interest rate and the type of customer (measured in the Vrf and Vrani variables) have superlative influence in order to calculate the provision requirements of the bank, which obviously have direct impact in the idle resources and profit of the entity.

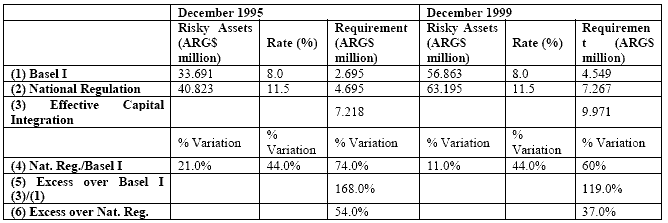

- For the Vrani variable, in the case of an SME which doesn’t have collateral the weight can be of 100% of the loan. - For the Vrf variable, the weight was 0.8 for an investment grade rated loan going up to 6 for a loan with nominal interest rate higher than 74% and 78% in dollars and pesos respectively, always on annual term; as we’re going to see later the SMEs financing are more based on working capital credit than loans, credit which had interest rates higher than 30%. In the Table 3 we’ve got a measure of the minimum capital requirements achieved by the private banking sector at September 1999, clearly we can see that the system was quite above the Basel suggestions: The requirements of own capital were 12/15% for risky assets and 11,5% for loans, other credits for financial intermediation and other financings; moreover, and in a broader definition, minimum capital requirements were 11,5%. As a result of it, the effective integration of minimum capital of the Argentinean system at 1999/2000 was 37% above the national regulation and 199% above the Basel adequacy. In terms of money the total requirements at the end 1999 were $ 17.600 millions which represented the 21% of deposits; this amount is quite significant meaning that a reduction would have released considerable resources to the system. Indeed an approximation calculated on that date affirmed that a reduction of requirements to a half would’ve represented a liberation of resources equivalent to 13% of the total loans lent to the non-financial private sector.

Table 3. MINIMUM CAPITAL REQUIREMENTS. PRIVATE BANKS.

ARGENTINA 1994/1999

Source: Translated from Aramburu (2000).

* We can mention two more circumstances that added indirectly to the concentration process:

After the Crisis of 1995 was constituted a deposit insurance fund (similar to the existent one in the U.S.) managed by SEDESA16 in order to increase the reliance on the financial system decreasing the risk of deposit running. Nevertheless the particularity of the Argentinean system was that the insurance covered deposits up to 30.000 pesos or dollars with an interest rate not higher than 2% of the rate applied by the National Bank (Banco Nacional de la República Argentina), leaving outside the rest of deposits and the banks that assumed more risk, making the entities with risky portfolios even more riskier (i.e. smaller institutions).

Finally the concentration process was encouraged by an institution called Fondo Fiduciario para el Desarrollo Provincial (Fiduciary Fund for the Provincial Development). It was created in order to attend liquidity problems of provincial banks and to support the privatization of them with funds provided by the IMF and the IDB, this instrument smoothed the privatization process which as mentioned before increased the concentration effect.

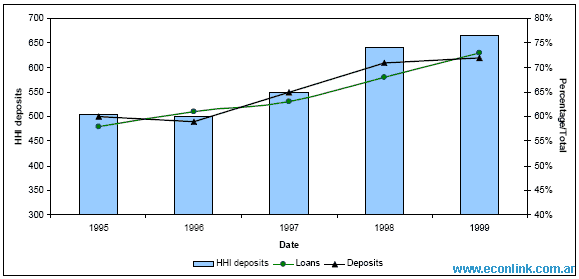

As mentioned previously 10% of the banks in the financial system shared 72% of deposits at the end of 1999 giving us an idea of the distribution of resources related with the size of institutions (see Figure 4 for detailed evolution).

Figure 4. EVOLUTION OF LOANS AND DEPOSITS CONCENTRATION.

ARGENTINA 1995/2000.

Source: Translated from Cuenin (2000).

Note: Loans: Loans issued by the 10 first private banks, Banco Nación and BAPRO

(publics) over the total loans issued.

Deposits: Deposits on the 10 first private banks, Banco Nación and BAPRO

(publics) over the total deposits of the system.

Note: In some cases, as seems to be the Argentinean one, the ‘systemic risk’ reached through prudential regulations wouldn’t be a relevant indicator of the decrease in financing costs of a country, as several sectors of the economy are not included in such benefits because indeed such benefits have been obtained through their exclusion.

Anonimo (30 de Ago de 2008). "Regulation". [en linea]

Dirección URL: https://www.econlink.com.ar/information-banking/regulation (Consultado el 14 de Mayo de 2021)