The Tequila Crises

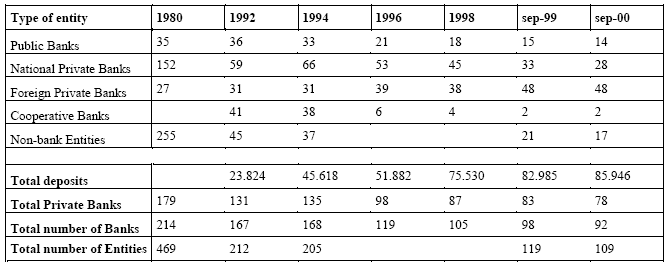

The concentration began with the `Tequila Crisis' at the beginning of 1995, at that time the financial system was made up of 168 organizations covered by the regulations of the BCRA (December 1994), on December 1996 this number had decreased down to 119 and towards the end of the period analyzed, on December 1999, the total number of institutions was of 92 (see Table 1). In between this reduction the only type of entity that increased his number were the foreign private banks from 31 up to 48. The privatization of public banks and the investment of foreign banks in the financial industry contributed to reduce the presence of national institutions mainly in the first year of the period.

Table 1. ARGENTINEAN FINANCIAL SYSTEM - ENTITIES - 1980/2000

Source: Author. Data from BCRA and Aramburu (2000).

Along with this was a deposit concentration from smaller to larger banks: in 1995 the first twelve banks shared the 58% of loans and the 60% of deposits, four years later in 1999 this amounts increased up to 73% and 72% respectively (Including the first 20 banks the amount of deposits was 83.7% of the total system at June 1999)12. Another characteristic of this process was the acquisition of the smaller banks by the larger ones instead of the constitution of larger banks through the merger or consolidation of several minor entities. For our purposes this event has superlative importance due to the fact that cooperative and regional banks (included in the minor segment) were the institutions with higher tendency to SMEs lending and better information of them.

Anonimo (30 de Ago de 2008). "The Tequila Crises". [en linea]

Dirección URL: https://www.econlink.com.ar/information-banking/tequila-crises (Consultado el 14 de Mayo de 2021)