Framework

Towards the end of the 90’s decade a particular debate took place in Argentina about the financing to the SMEs (Small and Medium Size Enterprises) between executives of the BCRA1 and some economists of the private sector2. In one of the positions the authorities of the BCRA argued that the companies had not been affected by the process of banking concentration that took place after the `Tequila Crisis' in 1994/95, they based their position on a series of research works coordinated by Guillermo Escudé (Escudé, 2001), at that time chief of the equipment of Economic and Financial Investigations of the BCRA. On the other sidewalk was the position of some economists like Leonardo Bleger (researcher of one of the only two cooperative banks of Argentina, the Credicoop Bank) defending previous financial publications adducing the worsening situation leaded by this process.

The debate was (and is) even more delicate to analyze due to the ‘slippery’ information handled and the difficulties to obtain it.

Beyond this particular discussion is generally accepted that for one reason or other the SMEs have been witnesses of an increasingly tighten financial conditions from the ‘formal financial sector’ (FFS)3 of the economy. Empirical evidence along those years (1994-2001) seems to show a ‘credit rationing’ process caused by the bank concentration situation that we’ll expose in this work.

But in this particular section we believe that is important to mention some macroeconomic aspects and particularities of the Argentinean economy of those years as the following ones.

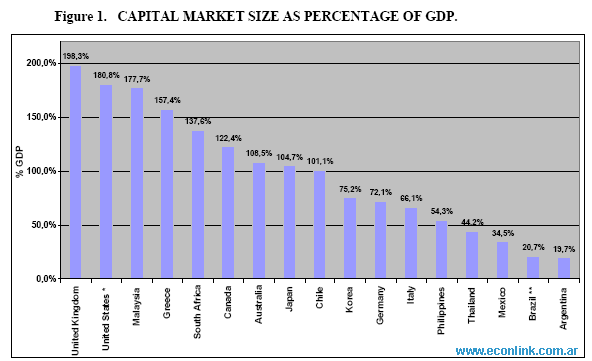

One characteristic not mentioned very often about the financial system in Argentina is the small participation of the capital market as financial intermediary. The size in terms of market capitalization to GDP was 19.7% on 1999, quite below the size of countries like E.E.U.U. (180.8%), Canada (122.4%), Australia (108.5%) or emerging countries like Malaysia (177.7%) and the Philippines (54.3%) on the same period, but even in comparison with Latin American countries like Chile (101.1%) or Mexico (34.5%) the capital market in Argentina was in an embryonic state (see Figure 1). Thus the Argentinean financial system was very dependent on the banking sector, shrinking the financing possibilities of the private sector and directly increasing a potential ‘credit rationing’ process.

Figure 1. CAPITAL MARKET SIZE AS PERCENTAGE OF GDP.

* US market capitalization and capital raised includes Amex, NASDAQ and NYSE.

** 1998 data (1999 GDP & GFCF Not Available)

Source: Author. Data from ‘Stock Markets Importance in the National Economy’,

World Federation of Exchanges.

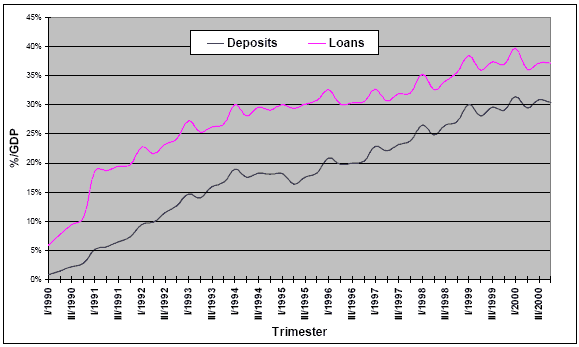

But even the financial sector was not enough developed and hadn’t reached the critical mass necessary to support an efficient system as intermediary. The size of the Formal Financial Sector (FFS) in the decade grown from 11% on 1990 up to 35 % on 1999 (see Figure 2) calculated as Total Loans/GDP, but was still small on an international comparison with Germany (145%) and EE.UU. (85%), or even with other Latin-American countries like Chile (70%), Brazil (53%) or Mexico (37%). This measure, and the previous mentioned, gives us a general idea of basic restriction in terms of available resources and a good intuition of the range covered by the FFS, both factors considered in the credit rationing theory. Moreover, and related with our concern, if we follow some researches (Berger, Rosen and Udell, 2001) we found that small business loan rates depends more on the size structure of the market than on the size of the lending bank.

Figure 2. LOANS AND DEPOSTIS - ARGENTINA 1990/2000

Source: Author. Data from INDEC and BCRA

Along with the mentioned situation of growth on the loan/deposits, undeveloped capital market and small financial system, the bank concentration process took place after the ‘Tequila Crisis’ on the second half of the decade.

This crisis was provoked by the devaluation of the Mexican peso on December 19944 and affected Latin-American emerging economies on different grades; in the case of the Argentinean economy it suffered a ‘fly to quality’ effect that caused the drainage of 18% of the total deposits in less than 10 months (The Argentinean case was particularly virulent due to the fixed exchange rate in force at that moment that pegged the peso 1/1 to the dollar).

As a result of this the bank sector went through a period of bankruptcies and acquisitions that reduced the number of total institutions 50% from December 1994 until December 1999. An important aspect of this consolidation process is that the regional and cooperative banks were the most beaten in terms of total number of branches, having a decrease of 9.48% and 15.54% respectively5 on their market participation.

Anonimo (30 de Ago de 2008). "Framework". [en linea]

Dirección URL: https://www.econlink.com.ar/node/1244 (Consultado el 14 de Mayo de 2021)